PDAB Chicanery: How Drug Affordability Boards Are Undermining Public Engagement

Prescription Drug Affordability Boards (PDABs) across the country are playing a dangerous game with public engagement—one where they keep changing the rules and moving the goalposts. From inadequate notice periods to last-minute document releases, these boards are creating barriers that echo troubling federal trends, effectively sidelining the very people who have the most at stake: patients.

These state-level games mirror concerning federal developments, most notably the rescinding of the Richardson Waiver by U.S. Department of Health & Human Services (HHS) Secretary Robert F. Kennedy, Jr. This action removed a 50-year precedent requiring public input on HHS rules—effectively telling patients and advocates their opinions aren't welcome at the policy table.

As these transparency rollbacks continue, people who rely on medications face increasing uncertainty about their access to life-sustaining treatments—while boards claim to represent their interests through processes that actively exclude them.

Maryland PDAB: How to Follow the Letter of the Law While Breaking Its Spirit

Maryland's Prescription Drug Affordability Board offers a master class in technical compliance that functionally blocks meaningful public participation. Their recent meeting preparation tactics exemplify how these boards can check procedural boxes while effectively sidelining patient voices.

On March 18, 2025, the Maryland PDAB posted a revised agenda for their upcoming March 24 meeting. This might seem unremarkable until you realize the public comment deadline was March 19—giving stakeholders exactly one day to review, analyze, and formulate responses to complex pharmaceutical policy documents. The revised agenda wasn't a minor update either. It contained material differences from the previous version, including a comprehensive cost review dossier for Farxiga, a medication critical for many people with diabetes and heart failure.

As CANN's letter to the board noted, "Posting the updated agenda with associated meeting materials the day before the deadline for comment is not a good faith effort in garnering public trust, nor does it display value in public input." The Maryland PDAB's approach creates a veneer of public engagement while practically guaranteeing that meaningful input will be minimal.

This pattern suggests the board views public comment as a procedural hurdle rather than a valuable source of insight. By technically fulfilling their obligation to post materials before the comment deadline (even if by mere hours), they've found a convenient loophole that undermines the very transparency standards that public notice requirements are designed to uphold.

The Maryland case isn't an anomaly. It's a symptom of a growing tendency to treat public engagement as an inconvenient formality rather than a crucial component of sound healthcare policy development.

The Federal Parallel: HHS and the Richardson Waiver

The state-level PDAB maneuvers don't exist in a vacuum. They mirror a troubling federal precedent set by HHS Secretary Robert F. Kennedy, Jr., who recently rescinded the Richardson Waiver—a decision that effectively slams the door on patient advocacy at the federal level.

The Richardson Waiver has a 50-year history. Established in 1971, it required HHS to subject matters relating to "public property, loans, grants, benefits, or contracts" to the American Procedures Act's notice and comment rulemaking guidelines. This waiver was created specifically to ensure public voices would be heard on matters that directly affect their health and well-being.

Now, that protection is gone. The new HHS rule claims the waiver "impose[s] costs on the Department and the public, are contrary to the efficient operation of the Department, and impede the Department's flexibility to adapt quickly to legal and policy mandates." This bureaucratic language translates to a simple message: we don't care what you think.

God forbid they remember who they work for.

And the impact is far-reaching. While Medicare remains protected under separate provisions of the Medicare Act, critical programs like Medicaid, SAMHSA, and the Administration for Children and Families now operate without mandated public comment periods. Legal experts note this could allow for swift implementation of controversial measures like Medicaid work requirements without going through normal rulemaking processes.

The timing is particularly ironic given the Office of Management and Budget's recent guidance letter emphasizing the importance of "broadening public participation and community engagement" and making it "easier for the American people to share their knowledge, needs, ideas, and lived experiences to improve how government works for and with them."

This federal retreat from transparency sets a dangerous tone that state-level boards appear eager to follow.

Other State PDAB Examples: Oregon and Colorado's Concerning Patterns

Maryland isn't alone in its questionable approach to public engagement. Oregon's PDAB recently decided to include Odefsey—an antiretroviral medication for people living with HIV—on its list for cost control exploration, contradicting previous discussions to protect these medications. While they claim they might reconsider based on affordability research, this flip-flop creates unnecessary anxiety for people who depend on these treatments.

Colorado's PDAB situation is particularly egregious. Since 2023, CANN has repeatedly requested that the board consult with the state health department about rebate impacts on public health infrastructure and patient affordability—concerns echoed by the former SDAP director and PDAB members themselves.

Yet Colorado PDAB staff have consistently avoided conducting a proper fiscal impact analysis, bluntly stating "We won't be doing that" when asked directly. This refusal persisted even as formal rulemaking began, which triggers statutory requirements for analyses under Colorado's Administrative Procedure Act.

The board has repeatedly postponed its first rulemaking hearing, effectively delaying compliance with transparency requirements. Meanwhile, the Joint Budget Committee has begun questioning the PDAB's financial accountability, receiving only partial responses about consultant costs and litigation expenses.

Most concerning is the disconnect between PDAB actions and demonstrated patient benefits. A 2024 analysis of Oregon's similar program showed states would need additional funds to maintain programs under an upper payment limit system—with no meaningful patient affordability improvements identified.

Patient Impact: Why This Matters

Behind the procedural games and policy maneuvers are real people whose lives hang in the balance. The Colorado PDAB's actions exemplify how these bureaucratic decisions create genuine fear and uncertainty for people with rare diseases and conditions requiring specialized medications.

Twelve-year-old Avery Kluck lives with Aicardi syndrome and faces life-threatening seizures that have been intensifying. Her doctors recommended Sabril, a powerful anticonvulsant costing up to $10,000 per month—a medication on Colorado's PDAB radar for potential price controls.

"We're to a point now where her seizures are getting more violent, and this is our last resort," explains Heather Kluck, Avery's mother. "And now I'm finding out she may not have access to it." The family faces an impossible choice between starting a medication that might become unavailable or watching their daughter suffer.

This uncertainty isn't theoretical. At least one pharmaceutical company has already threatened to pull drugs from Colorado if price caps are imposed. For medications like Sabril, which are dangerous to discontinue abruptly, such market exits could be catastrophic.

People living with cystic fibrosis also had to mobilize to prevent Colorado's PDAB from declaring Trikafta "unaffordable," with one parent describing the experience as "torturous for our family" and another stating: "It's an experiment, and it's really gross that they're doing it on people who are really sick."

The irony is painful: boards created to increase medication access may end up restricting it for those who need it most.

Conclusion

These boards, created under the guise of helping patients afford medications, are operating in ways that actively silence patient voices. From Maryland's last-minute document dumps to Colorado's refusal to conduct impact analyses and Oregon's policy reversals on critical medications, these boards are erecting barriers that exclude the very people who will bear the consequences of their decisions.

The problems run deeper than procedural failures. The fundamental approach of PDABs—attempting to control drug prices without adequately assessing impacts on patient access—risks creating catastrophic unintended consequences for people who depend on specialized medications. Avery Kluck and others living with rare conditions don't have the luxury of waiting while boards experiment with price controls that might make their life-saving treatments unavailable.

The pattern is clear: from the federal level with RFK Jr.'s dismantling of public comment protections to state PDABs playing administrative games, we're witnessing a coordinated retreat from meaningful public engagement in healthcare policy. This isn't just bad governance—it's dangerous for patients.

States should seriously reconsider whether PDABs serve any legitimate purpose beyond political theater. At minimum, stakeholders across the healthcare spectrum must demand that these boards either implement truly transparent, patient-centered processes or acknowledge they cannot fulfill their stated mission without causing harm to the very people they claim to help.

How the IRA's Price Controls Could Backfire on Patients

For millions of Americans, health insurance offers a false promise. Despite paying premiums, deductibles, and copays, many still find themselves struggling to afford essential healthcare. In fact, a recent survey found that a staggering 43% of adults with employer-sponsored insurance—often considered the gold standard of coverage—find healthcare difficult to afford. This affordability crisis is poised to worsen, as the latest National Health Expenditure projections from the Centers for Medicare & Medicaid Services (CMS) reveal a troubling trend: while government spending on prescription drugs is projected to decrease, patient out-of-pocket costs are expected to rise. The projections forecast an 8.9% increase in hospital expenditures, coupled with a 1.4% decrease in retail prescription drug spending. This shift, driven in part by the Inflation Reduction Act's (IRA) price control provisions, threatens to undermine the law's intended goal of affordable healthcare and exacerbate existing health inequities. While the IRA aims to lower drug costs, its focus on price controls, rather than comprehensive patient protection mechanisms, is creating misaligned incentives that could backfire on the very people it aims to help.

The IRA's Price Controls: A Double-Edged Sword

The IRA's approach to lowering drug costs centers on empowering the government to directly negotiate prices with pharmaceutical companies. This change tackles a provision in the Medicare Part D program known as the "non-interference" clause, which previously prevented the government from directly negotiating drug prices. As a Kaiser Family Foundation (KFF) issue brief explains, "The Part D non-interference clause has been a longstanding target for some policymakers because it has limited the ability of the federal government to leverage lower prices, particularly for high-priced drugs without competitors." While this "non-interference" clause has long been a target for reform, the IRA's implementation creates a ripple effect that extends beyond simply lowering the sticker price of medications. The Congressional Budget Office (CBO) estimates that these drug pricing provisions will reduce the federal deficit by $237 billion over 10 years, suggesting a significant shift in spending away from the government. However, this shift comes at a cost. The IRA's emphasis on price controls, rather than comprehensive patient protection mechanisms, disrupts existing rebate structures that have been crucial in expanding access to medications, particularly for low-income patients and those with chronic conditions.

Programs like 340B and Medicaid rely on a system of manufacturer rebates to make medications more affordable. In essence, drug companies provide rebates to these programs in exchange for having their drugs included on formularies and made available to a large pool of patients. These rebates help offset the cost of medications, allowing safety-net providers to stretch their limited resources and serve more patients. However, the IRA's price controls could disrupt this delicate balance. By directly negotiating lower prices with manufacturers, the government might inadvertently reduce the incentive for companies to offer substantial rebates to programs like 340B and Medicaid. This could lead to higher costs for these programs and ultimately limit access to medications for vulnerable populations.

This means that programs like 340B and Medicaid, which rely on manufacturer rebates to offset costs and provide affordable medications to vulnerable populations, could be significantly undermined by the IRA's price control measures.

Further complicating the issue is the potential for pharmaceutical companies to adapt to the IRA's price controls by strategically setting higher launch prices for new drugs. This tactic allows them to recoup potential losses from negotiated prices in the future, effectively shifting the cost burden onto other payers, including patients. The CBO projects that this trend of higher launch prices would disproportionately impact Medicaid spending, placing a greater strain on a program already facing significant enrollment fluctuations and budgetary pressures. The KFF brief warns that, "Drug manufacturers may respond to the inflation rebates by increasing launch prices for drugs that come to market in the future." This means that while the IRA might appear to lower drug costs in the short term, it could inadvertently fuel a long-term trend of rising prices for new medications, ultimately impacting patient affordability and access to innovative therapies.

Hospitals: Benefiting from the System While Patients Pay the Price

The CMS projections forecast an alarming 8.9% increase in hospital expenditures, raising questions about the drivers of this unsustainable growth. A closer look reveals a troubling connection between this trend and the 340B Drug Pricing Program, a federal initiative designed to help safety-net hospitals provide affordable medications to low-income patients. The CBO's analysis of 340B spending reveals an explosive 19% average annual growth from 2010 to 2021, significantly outpacing overall healthcare spending growth. This dramatic increase is largely attributed to hospitals, particularly those specializing in oncology, which are increasingly purchasing high-priced specialty drugs through the program. As the CBO presentation states, "340B facilities benefit from the program because the difference between the acquisition cost and the amount they are paid (often called the 'spread') is larger for drugs acquired through the 340B program." This suggests that hospitals are capitalizing on the 340B program's discounts to acquire expensive medications, potentially driving up their overall spending. But are these savings being passed on to patients? Evidence suggests otherwise.

This suspicion of hospitals leveraging the 340B program for profit is further reinforced by a UC Berkeley School of Public Health study which found that hospitals are charging insurers exorbitant markups for infused specialty drugs, many of which are likely acquired through 340B. The study reveals that hospitals eligible for 340B discounts charge insurers a staggering 300% more for these drugs than their acquisition costs, effectively pocketing a substantial profit margin. This practice raises serious concerns about whether the 340B program, designed to help vulnerable patients access affordable medications, is instead being exploited by hospitals to boost their bottom line. As Christopher Whaley, a co-author of the UC Berkeley study, aptly points out, "It is ironic that some hospitals earn more from administering drugs than do drug firms for developing and manufacturing those drugs. At least drug firms invest part of their revenues in innovation; hospitals invest nothing." This highlights a perverse incentive structure where hospitals benefit financially from a program intended to help patients, while those same patients are often left facing inflated prices for essential medications and crippling medical debt.

The Affordability Crisis: A Broken Promise for Patients

This concerning trend of rising healthcare costs and shifting burdens is not limited to those reliant on safety-net programs. The Commonwealth Fund's 2023 Health Care Affordability Survey paints a bleak picture of the widespread affordability crisis facing Americans across all insurance types. The survey found that 43% of adults with employer coverage find healthcare difficult to afford, shattering the illusion that employer-sponsored insurance guarantees financial protection. These findings challenge the fundamental assumption that health insurance in the United States equates to affordable access to care. As the survey report states, "While having health insurance is always better than not having it, the survey findings challenge the implicit assumption that health insurance in the United States buys affordable access to care." This sentiment is echoed by millions of Americans who, despite having insurance, are forced to make difficult choices between their health and their financial well-being.

Even the IRA's lauded out-of-pocket (OOP) cap on Part D drug costs, while offering some relief, fails to address the root causes of this affordability crisis. An analysis by Avalere reveals that even with the cap in place, a significant number of Medicare beneficiaries will continue to face high healthcare costs, particularly those with lower incomes or specific health conditions. The analysis projects that 182,000 beneficiaries will spend over 10% of their income on Part D drug costs in 2025, despite the OOP cap. This sobering statistic underscores the limitations of focusing solely on OOP costs without addressing the underlying drivers of high drug prices and healthcare spending. As the Avalere analysis cautions, "High OOP costs are expected to result in many enrollees still facing affordability challenges in 2025." The findings from both the Avalere analysis and the Commonwealth Fund survey highlight a critical gap in the IRA's approach: it fails to adequately protect the most vulnerable patients from the financial burden of healthcare.

A Call for Patient-Centered Solutions

The CMS projections, alongside independent analyses of the pharmaceutical market and patient affordability, paint a clear picture: the current trajectory of US healthcare spending is unsustainable and inequitable. The IRA's price control provisions, while well-intentioned, risk exacerbating the affordability crisis by disrupting existing rebate structures, incentivizing higher launch prices for new drugs, and shifting costs onto patients. This shift is further compounded by unchecked hospital spending, particularly on high-priced specialty medications acquired through the 340B program. The result is a system where hospitals and pharmaceutical companies benefit, while patients—especially those with lower incomes or chronic conditions—are left struggling to afford essential care.

To be sure, the IRA includes provisions aimed at directly helping patients, such as the out-of-pocket cap on Part D drug costs and the expansion of subsidies for marketplace plans. These are positive steps towards easing the financial burden of healthcare for many Americans. However, the law's broader focus on price controls, without sufficient attention to patient protection mechanisms and the potential for unintended consequences, threatens to undermine these gains and create new challenges for those who rely on safety-net programs like 340B and Medicaid.

It's time for a fundamental shift in our approach to healthcare reform. Policymakers must move beyond a narrow focus on price controls and embrace a patient-centered approach that prioritizes affordability, access, and equity. This requires a multi-pronged strategy that includes:

Reassessing the IRA's reliance on price controls: Instead of simply dictating prices, policymakers should explore alternative approaches that strengthen patient protections, preserve rebate structures that support broader access, and address the potential for cost-shifting onto patients.

Tackling hospital pricing practices: Increased transparency and accountability in hospital pricing, particularly for inpatient medications, is necessary to ensure that safety-net programs like 340B are truly benefiting patients and not being exploited for profit.

Investing in alternative care models: Promoting value-based care and investing in primary and preventive care can reduce reliance on expensive hospital stays, improve health outcomes, and make healthcare more affordable for everyone.

The promise of affordable, accessible healthcare for all Americans remains unfulfilled. We must demand a healthcare system that puts patients first, not profits. Only then can we ensure that everyone has the opportunity to live a healthy and fulfilling life, regardless of their income or health status.

Upper-Payment Limits; Drug "Affordability" Boards Risk Medication Access

The opinion piece, authored by Jen Laws, CANN’s President & CEO, originally published in the September 2, 2023, print edition of the Denver Post. CANN will be hosting a free “PDAB 101” webinar for patients, advocates, and all public health stakeholders on November 1, 2023. Pre-registration is required. Register by clicking here.

To successfully combat the HIV epidemic and defeat other chronic conditions, patients must have uninterrupted access to the most effective medicines recommended by their doctors. As efforts to ensure patients can access their medicines are being defined in the public sphere, many state legislatures continue to advance policies and proposals focused on addressing patient affordability challenges.

However, many such actions fail to address high out-of-pocket costs and instead focus on lowering costs for other stakeholders within the health care system, like lowering costs and increasing profits for health insurers neglecting the patients they were intended to protect.

In Colorado and several other states across the country, lawmakers have empowered Prescription Drug Affordability Boards (PDABs) to address the rising costs that patients pay for prescription medicines. PDABs have the authority to select and review drug list prices and can recommend policies for drugs deemed "unaffordable." These list prices aren't something patients generally pay, rather we pay co-pays or are able to manage costs with patient assistance programs.

Despite this, one such policy being considered by the Colorado PDAB and similar boards in other states is an upper-payment limit (UPL). A UPL is a payment limit or ceiling that applies to all purchases and payments for certain high-cost drugs and does not necessarily translate into a "cost limit" for patients.

When UPLs are set, reimbursement rates are lowered for hospitals or clinics giving them less incentive to purchase specific drugs even though it may be the most effective medication to help a patient manage a chronic condition. When reimbursement rates are lowered through a UPL, it can also lead to barriers to biopharmaceutical companies investing in and supplying new innovative medicines to health facilities, making it difficult for doctors to prescribe treatments they think are best suited for their patients. While well intentioned, patients often bear the brunt of the challenges with such policies.

The impacts of the UPL process are only compounded when we consider the potential impact on the 340B Drug Pricing Program, a federal safety-net program that helps health facilities serve low-income and uninsured patients by offering them discounted drugs. Under the program, qualified clinics and other covered entities buy treatments at a discount to help treat vulnerable patients and get to keep the difference between the reimbursement rate and the discounted price leveraging those dollars to provide needy patients with medications and care they might not otherwise be able to afford.

Under a UPL, health facilities such as hospitals or clinics will receive lower reimbursements for prescribed treatments and therefore generate fewer dollars to support patients and the care we need to live and thrive. If the PDAB sets restrictive UPLs for drugs for chronic conditions like HIV, health facilities and the health professionals tasked with providing care will be faced with the decision to potentially stop prescribing these medicines and face having to cut support services that patients have come to rely on.

At a recent meeting of Colorado PDAB stakeholders, following the board's unanimous approval of the list of drugs eligible for an affordability review process, I voiced concerns about the approach to determining the value of lifesaving treatments for patients living with or at risk for HIV, hepatitis C (HCV), and other complex conditions. My concerns have only grown since, most recently, the state PDAB selected five drugs to undergo a formal affordability review including a treatment for HIV.

Many patients and other stakeholders have raised alarm to other drugs that are now subject to review to treat complex conditions such as psoriasis, arthritis, psoriatic arthritis, and cystic fibrosis. The implications of the Colorado drug "affordability" board's recent actions on patient access are grave and set a dangerous precedent. Ten states including Colorado have already established PDABs, and many others are following suit.

Those support services and continuity of care are critical to empower communities and improve the quality of life for people living with and managing conditions like HIV and hepatitis C. Despite the PDAB being "sold" to the public as a measure to improve patient experiences and access to care, the current model fails to prioritize patients at all.

Colorado is home to more than 13,000 people living with HIV and has been at the forefront of combating the disease. This year, state lawmakers advanced model legislation that protects patients' access to HIV prevention medication. However, the recent actions from the drug "affordability" board and short-sighted policies like the UPL process or mandatory generic switching could derail progress toward ending the HIV epidemic.

Price controls are, and will continue to be, a short-term, short-sighted "fix" with long-term consequences for patients living with chronic conditions. Policy efforts to address affordability must prioritize patient access and the ability for doctors to prescribe effective treatments. Colorado's PDAB, as it currently stands, falls short of that.

Prescription Drug Advisory Boards: Who is Impacted and How to get Involved

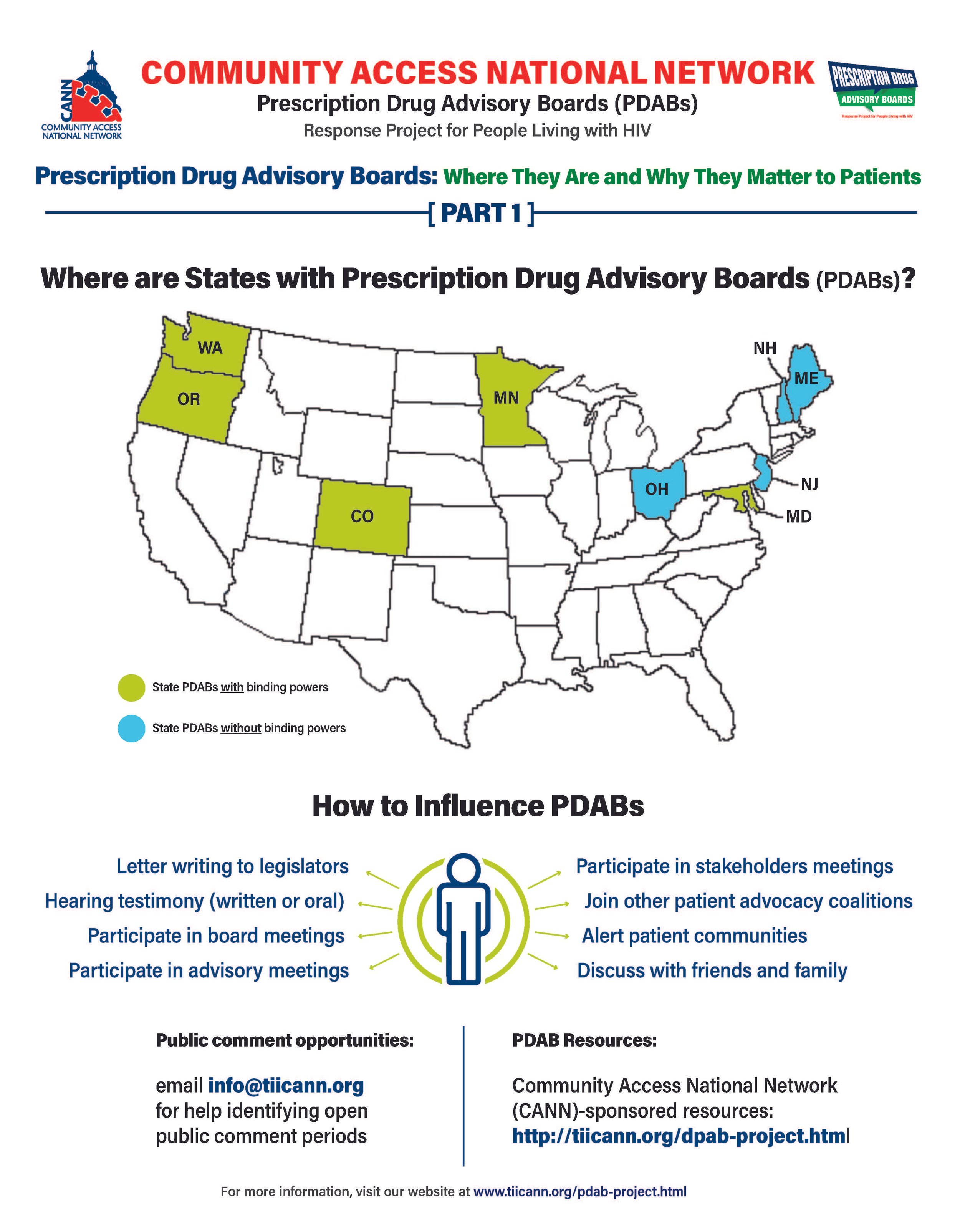

The prescription drug advisory board (PDAB) train keeps chugging along. Presently, there are nine (9) states that had, have or are in the process of enacting PDAB legislation: Washington, Oregon, Colorado, Michigan, Minnesota, New Jersey, New Hampshire, Maryland, and Maine. Ohio, it would seem, has abandoned their PDAB efforts. Their geographical variance reflects the diversity of their structures. Some of the boards have five members, and some have seven. While all are appointed by the governor, they differ regarding which departments they are associated with. For example, Colorado’s is associated with the Division of Insurance, and Oregon’s is associated with the Department of Consumer and Business Services.

The assortment of structure does not stop at department association. The number of drugs to be selected annually for review also varies, such as Colorado with five and Oregon with nine. Even the number of advisory council members lacks consistency. The New Jersey DPAB advisory council has twenty-seven (27) members, while Colorado’s has fifteen (15). Inconsistency in structure means inconsistency in operations. Thus, the help or harm patients ultimately receive will vary drastically from state to state. The most important differences are the powers bestowed upon the various DPABs. In addition to shaping many policy recommendations, five (5) currently have the ability to enact binding upper payment limit (UPL) settings: Washington, Oregon, Colorado, Maryland, and Minnesota.

An upper payment limit sets a maximum for all purchases and payments for expensive drugs. By setting UPLs for high-cost medications, improved ability to finance treatment equals greater access to high-cost medicines. A UPL sets a ceiling on what a payor may reimburse for a drug, including public health plans, like Medicaid.

Patients, advocates, caregivers, and providers are concerned about PDABs because the outcomes of theory versus practice can have dire consequences. Theoretically, PDABs should reduce what patients spend out of pocket for medications and lower government prescription drug expenditures. However, the varied ways different PDABs are set to operate could jeopardize goals. Focusing on lowering reimbursement rates could affect the funds used as a lifeline by organizations benefiting from the 340B pricing program even while not meaningfully reducing patient out-of-pocket costs. If reimbursement limits are set too low, those entities will have drastic reductions in the funding they use for services for the vulnerable populations they serve. UPLs could ultimately increase patients' financial burden if payers increase cost-sharing and change formulary tiers to offset profit loss from pricing changes or institute utilization management practices like step-therapy or prior authorization. Increasing patient administrative burden necessarily decreases access to medication. When patients are made to spend more time arguing for the medication they and their provider have determined to be the best suited for them, rather than simply being able to access the medication, the more likely patients are to have to miss work to fight for the medication they need or make multiple pharmacy trips – or suffer the health and financial consequences of having to “fail” a different medication first. PDAB changes could affect provider reimbursement, which could be lowered with pervasive pricing changes. Decreased provider reimbursement could result in additional costs being passed onto patients or, in the situation of 340B, safety-net providers, reduce available funding for support services patients have come to rely upon.

The divergent factors that different PDABs use for decision-making are of concern as well. It is not enough to just look at the list price of drugs and the number of people using them. For example, some worthwhile criteria for consideration of affordability challenges codified in Oregon’s PDAB legislation are: “Whether the prescription drug has led to health inequities in communities of color… The impact on patient access to the drug considering standard prescription drug benefit designs in health insurance plans offered…The relative financial impacts to health, medical or social services costs as can be quantified and compared to the costs of existing therapeutic alternatives…”. But few of these PDABs consider payer-related issues like limited in-network pharmacies, discriminatory reimbursement, patient steering mechanisms, or frequency of utilization management as hindrances to patients getting our medications.

Effectively seeking and considering input from patients, caregivers, and frontline healthcare providers is also of concern. The legislation of various DPABs specifies the conflicts of interest that board members cannot have and must disclose. Some even have appointed alternates to allow board members to recuse themselves from making decisions on drugs with which they have financial and ethical conflicts. However, most of the advisory boards are providers, government, and otherwise industry-related. The board members are even required to have advanced degrees and experience in health economics, administration, and more. The majority of the discourse is not weighted towards the patient and our advocates. Few, if any, specific active outreach measures when it comes to seeking patient input. For example, the Ryan White HIV/AIDS Program requires patient and community engagement outlets in planning activities. But no PDAB legislation, to our knowledge, requires PDABs to engage with these established patient-oriented consortia. We know well in HIV that expecting already burdened patients often struggle to meet limit engagement opportunities from government boards – we know the very best practices are going to patients, rather than expecting patients to come to these boards. Beyond these limited engagement opportunities and failure to reach out to spaces where patients are already engaged, some states have exceptionally short periods in which to gather these inputs.

However, depending on the individual state’s DPAB structure, there is an opportunity for patients, caregivers, and organizations to give input through public comment periods and particular meetings aimed at stakeholder engagement. For states considering PDAB legislation, like Michigan, patients can and should engage in the legislative process. One place to keep abreast of different state’s PDAB activities is the Community Access National Network’s PDAB microsite. The microsite has an interactive map where you can access various states’ PDAB sites as they are created. States with fully formed PDABs have sites that display their scheduled meetings, previous decisions made, agendas for future sessions, and, most notably, details of the process for the public to provide input. Most of the meetings are open to the public, with the public invited to provide oral public comment or to submit written comments. Attending meetings and speaking directly to the boards is a way to have board members and others hear directly from those who will be affected by their decisions. Written public comment is also essential, especially from community patient advocacy organizations. Some DPABS also provide access to virtual meetings where stakeholders can provide feedback and input.

Medicare has six protected drug classes: anticonvulsants, antidepressants, antineoplastics, antipsychotics, antiretrovirals, and immunosuppressants. This means that Medicare Part D formularies must include them but that protection exists because we know how important these medications are. Antiretrovirals and oncology medications are a part of that list because adversely affecting the mechanisms of access to those drug classes is life-threatening to those who need them. It is imperative that continued scrutiny be placed upon DPABs to ensure that their benefits are patient-focused, like reducing administrative burden and barriers to care, rather than a mask that ultimately benefits payers by increasing their profits.

Prescription Drug Advisory Boards: What They Are and Why They Matter to Patients

It’s no secret that the high cost of healthcare is a significant concern for most Americans. The total national health expenditure in 2021 increased by 2.7% from the previous year to 4.3 trillion dollars which was 18.3% of the gross domestic product. The federal government held the majority of the spending burden at 34%, with individual households a close second at 27%. A cornerstone component of medical treatment is the access to prescription drugs. In 2019 in the U.S., the government and private insurers spent twice as much on prescription drugs as in other comparatively wealthy countries. Despite catchy phrases that poll well, and “simple” solutions by politicians that promise to fix the problem—such as Prescription Drug Advisory Boards (also known as Drug Pricing Advisory Boards)—it is mindful to remember one thing: if it sounds good to be true, then it probably isn’t true.

CANN PDAB infographic: What are they and why do they matter? (https://tiicann.org/dpab-project.html)

While list prices of prescription drugs continue to increase, medication costs do not represent the largest share of healthcare costs or the largest growth in healthcare costs in the United States. The cost burden on patients is so untenable for many that some have to decide between paying for medications, food, or mortgages. However, due to a number of incentives and the role of loosely regulated pharmacy benefit managers (PBMs), there is little direct relationship between drug list prices and patient cost burdens. This fact is only just now being appreciated by lawmakers but is not currently reflected in our healthcare funding schemes. As such, the discourse surrounding lowering cost is a consistently turbulent sea navigated by diverse public and private parties, with the language around drug pricing assuming efforts to curb costs relate to patient costs and access – but not explicitly saying so (and for good reason). Some proposals are government related, such as federal drug pricing proposals. Recent developments are state-level focused closer to home. One such development is the Prescription Drug Advisory Boards, or PDABs.

PDABs are part of state divisions of insurance. Drug pricing efforts, in the general sense, could be a good thing. PDABs are being marketed to the public as a better means to make drugs more affordable for patients. However, the details of the implementation of developing PDABs are wherein lies significant challenges. Overall, the boards focus specifically on the prices of the drugs. However, the focus on pricing is mainly related to what governments, insurance companies, hospitals, and pharmacies are paying for the medications. This purview and the monitored metrics associated with PDABs do not necessarily translate into the actual costs patients pay at the pharmacy counter.

Because these designs are singularly focused on the “cost” to payors, current proposals and initiatives benefit both public and private payors at the expense of the patient access and the provider-patient relationship. It is unacceptable for any planned PDAB activity to disrupt the patient-provider relationship. Community Access National Network (CANN) has consistently opposed any policy initiative that might increase administrative barriers and patient burdens. Two examples are step-therapy and prior authorization. Activities such as these are considered what is known as utilization management. Utilization management helps lower prescription drug spending for public and private payors but creates additional costs for patients financially and logistically, affecting their continuity of care, amounting to a cost burden shift, not a meaningful increase of access to affordable, high-quality care and treatment for patients.

Additionally, the narrow specific focus on the list prices of drugs overlooks essential issues. Lowering the list price for medications can, for example, harm organizations that depend on revenues from the 340B Drug Pricing Program. The 340B program allows safety net clinics and organizations to purchase prescription drugs from manufacturers at a discounted price while being reimbursed by insurance carriers at a non-discounted cost. The surplus enables these entities to provide many services that the low-income populations they serve depend on. This is especially vital to low-income people living with HIV that do not have the means to afford all of their healthcare needs.

It is imperative that PDABs receive input directly from patients and caregivers as well. PDABs are aggregating a large amount of data. However, more of that data needs to include considerations of the patient experience. For example, drug rebate reductions can impact care and support services, such as transportation assistance or mental health services at federally qualified health centers (FQHCs). Moreover, there needs to be an examination of the actual pass-through savings to patients. Most importantly, PDABs need to explore how pricing decisions affect patient access. A lower drug list price is not beneficial to patients if it creates or increases administrative burdens or increases costs for patients in other ways outside of paying for the cost of medication.

Most policymakers do not always have robust experience in understanding the nuances of dealing with public health programs, clinics, and populations. This is especially true regarding the marginalized community of people living with or at risk for acquiring HIV, those affected by Hepatitis C, or people who use drugs. PDABS must be held accountable for acquiring anecdotal qualitative and quantitative data regarding patient experience, accessibility, and affordability while developing recommendations related to drug pricing. As it stands, of the states that have implemented a PDAB, none have statutorily mandated metrics monitoring patient experience and access.

Patients, caregivers, and advocates with direct experience and greater understanding of the policy landscape around healthcare access play a vital role in helping to shape legislation and informing proper implementation of programs to meet the goals those programs were “sold” on. If monitored metrics do not consider or reflect patient experiences, then the program is simply not about increasing access for patients.

PDABs, fortunately, do have numerous opportunities for patients, caregivers, advocates, and providers to become involved and to elevate patient priorities over that of other stakeholders. Getting involved and staying involved with a state’s PDAB work is critically necessary to ensure any final work or regulation is patient-focused.

CANN will be present and offering feedback at various PDAB meetings in affected states. The next meeting CANN will be attending is virtual for the state of Colorado, on July 13th at 10am Mountain time. You can register here and participate in ensuring any action taken reflects patient needs.

HCV ‘Netflix’ Model Reveals Price Isn’t the Biggest Problem

A recent article published to STAT News offers a detailed view on how in 2019, Louisiana and Washington State invested in the headline making, flashy deal of the century. It involved an unlimited supply of direct acting agents (DAAs) known to cure Hepatitis C (HCV) for the price of a standard “subscription” fee. Now, it wasn’t a $9.99 per month, endless video watching gig, but rather thousands of prescription fills per month meant to address the needs of each state’s Medicaid program and correctional facilities. However, such penned deals are estimated to have already saved the two states hundreds of millions of dollars. The subscription model is exciting, STAT reports the Biden Administration wants to build a similar program on the federal level. So that should solve the problem, right?

Not so fast! The data, and the experts, offer a more cautious tone.

A heady launch led to incarcerated people, who had previously sued for access to these curative treatments, finally received them. The states moved to reduce the “utilization” restrictions, like prior authorizations or requirements to have a specialist supervise the care. But that steady progress slowed to a trickle, and signs exist that the progress is already being lost.

2020 brought well-known disruptions in care, including reductions in screenings in hospital settings, and strained prison and jail staffing. And while the COVID-19 pandemic’s crisis phase may provide somewhat of a pass, it doesn’t explain all of the losses and slow return to focus on each state’s plan to eliminate HCV.

What’s at the core of the elimination efforts missing their mark? The planning and implementation of the program hinged on the idea that drug cost was the primary issue as to why people weren’t accessing this curative treatment. Turns out, even if the drug is free to patients and affordable for states, there’s more to care than cost, especially in public health. Despite hundreds of millions in saved dollars, neither state set aside enough (or any) of those projected savings to bolster provider education, invest in the human capital necessary in health care entities serving the most affected public (like federally qualified health centers), or reimbursement for “street medicine”, or innovative program designs, or – as especially is the case in Louisiana – ensuring state health departments have the staff dedicated toward HCV elimination.

Let us take a second to consider that last point. Louisiana’s STI, HIV, and Hepatitis Program is in pretty desperate shape. A long list of job openings reflects the fact that much of the program’s staff are subcontractors with those contracts spread across three different entities, a result supposedly of former Governor Bobby Jindal’s efforts to gut the program entirely, the program can’t attract or retain talent because wages remain ridiculously uncompetitive and, in instances where staff is offered promotions, they have to consider the trade off of losing their health benefits and accrued vacation days for a short period of time if that position is being held under one of the other three contracts. With that kind of tangled web to navigate, no wonder the state is falling behind. On social media, some state legislators have openly mocked the Louisiana Department of Health asking for budget increases. None of that touches the lack of physical access points of care patients need in more rural parts of the state – sometimes driving hours to find a provider to treat their HCV – or the failure of jails and hospitals to universally implement the screening elements of a successful elimination plan.

With the Biden Administration already struggling to get Congress to fund similar subscription plans for COVID-19 testing and treatment and flat out refusal from certain Senators to fund the Centers for Disease Control and Prevention’s sexually transmitted infections work despite data showing that under no uncertain terms the need exists, is there any real hope an appetite exists for similar funding to eliminate HCV in the United States?

One thing is clear, the cost of medication a payer sees (public or private) is not the biggest barrier to care for patients. Indeed, few patients care very much at all about what a payer’s costs are – patients care what their costs are and that includes costs not readily recognized by payers (like costs associated with time off work due to narrowed provider networks), or the time it takes providers to build trust in highly affected, highly marginalized communities. In fact, if policymakers wish to make the great investments necessary to eliminating HCV, they can start with sensible steps like requiring and enforcing hospitals to implement opt-out screening activities by way of rule making or legislation directing HCV screening to be a standard of care and integrated into the state’s essential health benefits benchmarks. Similarly, those same policymakers could require and enforce implementation of universal screening in all carceral settings or introduce legislation which requires departments of corrections to provide DAA to all incarcerated people diagnosed with HCV, regardless of cirrhosis status. States could require commercial health plans to cover DAAs at no cost sharing or require that all covered entities in that state charge a flat dispensing fee for DAAs (recognizing abusive dispensing fees for DAAs necessarily reduce the dollars available to support public health programming). States could dig into consolidation of access points to care to the exclusion of entire geographies hard hit by disparities.

There’s so much more to “access” to care than what a payer negotiates with a drug manufacturer and focusing exclusively on the issue of drug pricing. Without robust planning, reinvestment of “savings” into the logistical supports – including competitive wages and benefits packages for labor needs – necessary to feed the roots of this tree, all we’ll be left with is the low hanging fruit and rotten wood. And if we’re not careful, efforts at Ending the HIV Epidemic might end up looking much the same.

Biden’s State of the Union: Bold Promises on Public Health

On March 1st, President Biden delivered his first State of the Union Address to both chambers of Congress and the American people at large. Amid a slew of foreign and domestic policy proclamations, particular attention should be afforded to the statements and commitments made about addressing the COVID-19 pandemic and public health, more broadly. Championing the landmark legislation that was the American Rescue Plan, the President laid out how the legislation’s programming reduced food pantry lines, increased employment, and how expansion of the Affordable Care Act’s subsidies resulted in lower insurance premiums for many Americans. In addressing the COVID-19 pandemic, Biden also recognized a sobering outcome that will shake the nation: within the next few weeks, the United States’ official COVID death toll will surpass one million people. Though the President misstated the moment in that those empty seats at dinner tables will be more than a million; on average each COVID death has impacted 9 other people, including orphaning children across the country. Biden then shifted the address, citing the Centers for Disease Control and Prevention’s recent announcement of adjust masking guidelines and metrics of risk, trying to signal a much-needed political win in the fight against COVID. However, immediately following these statements, the President also focused on providing the country with another round of free at-home COVID-19 tests and implementing a tactic already well-known in the HIV space: test-to-treat, with added bonus of the program following the COVID vaccine model and having no out-of-pocket expense for patients.

The program ideals outlined in the days that followed found some confusion, need for clarity, and even some professional association bickering. Public health professionals who have long advocated for more robust responses to the pandemic took to news outlets to vent their frustrations and the American Medical Association drew derision on social media for their statement discouraging pharmacists prescription and provision of COVID antivirals. Pharmacists have long been a target for HIV advocates, especially in terms of increasing pre-exposure prophylaxis (PrEP) access and decreasing test to treat initiation delays. Wouldn’t it be nice if this COVID program provided a model outside of vaccination in which pharmacists could also serve a more robust role in facilitating seamless treatment and prevention? The meaningful hiccups the administration and advocates should keep a close eye on in this regard is the labor shortage of pharmacists, closing of more rural locations for chain pharmacies, and any developments around anti-competitive practices of pharmacy benefit managers (PBMs) associated with pharmacies. Consequences of these will extend beyond immediate COVID programming and ideal HIV programming.

The President also made statements referring to medication costs and price controls and needing to make sure more Americans could afford their care. However, details were lacking and if any recent effort is indicative, singularly focusing on manufacturer list prices won’t address patient costs or get much anywhere. Buyer beware, some proposals in the apparently sunk Build Back better legislation would also cut provider compensation in public payer programs, a dire consequence as the nation struggles with health care staffing shortages. Those shortages should be noted in detail because the American Rescue Plan provided funding meant to supplement the financial demands of staffing a pandemic and there’s good reason to suspect administrators, rather than providers, enjoyed the fruits of that labor. Further, most Americans experience their out-of-pocket costs of care due to the benefit design of their insurer (and PBM), not the manufacturer list price. Indeed, the Biden Administration appears to eb as insurer friendly as the Obama admin. To impact the costs facing patients more meaningfully at the pharmacy counter and other burdens in accessing medication, the Biden administration should focus more on developing patient protections via the regulatory process, limiting the aggressive utilization management (or deny-first coverage) policies, increasing formulary restrictions, and discriminatory plan design. Some of the tools for doing so already exist, but the federal government has yet to curb the tactics of payers in avoiding their responsibilities under the ACA’s medical-loss-ratio rules or ensure payers are not inappropriately applying cost-sharing for qualifying preventative medications and services.

The President also became the first to mention “harm reduction” in a State of the Union Address. Urging Congress to pass the Mainstreaming Addiction Treatment Act (MAT Act), President Biden is seeking to fulfill his commitments to address the opioid epidemic and move toward modernizing domestic drug policy. In a sign of acknowledgment of the scope and size of substance use epidemic in the country, Biden endorsed recovery programs and recognized the more than 23 million people struggling with addiction in the country. Immediately following the MAT Act mention, the President moved on to address of a lesser defined but equally important need in encouraging commitment to a robust set of policy ideals aimed at meeting the mental health needs of the country.

All these good things can easily be outweighed by what wasn’t mentioned. President Biden did not mention any interest in extending another round of stimulus payments, despite the program resulting in one of the largest reductions in poverty in US history. And while there was focus on rebuilding the nation’s health care staffing, no mention was afforded to rebuilding the nation’s public health infrastructure. Meanwhile, we’ve known for quite some time poverty as a notable association with HIV and decreasing poverty also decreases HIV risks and prevalence, data remains in the decline with regard to HIV and STI screenings, Hepatitis C rates are still on the rise, and inconsistencies in PrEP usage during the height of initial COVID waves likely foretells a more diverse at-risk community. Even the government’s own HIV.gov webpage dedicated to the State of the Union fails to mention any HIV or HCV specific programming efforts associated with the address.

While there’s much to celebrate about the President’s COVID goals, advocates should be cautious about projecting those goals onto other public health efforts. Afterall, COVID proved we could provide more up to date reporting than the 2 year delays we typically see in HIV and HCV surveillance, but we haven’t. COVID-related telemedicine expansion was welcomed by patients across the nation but Congress is poised to claw back those gains. For many of us, while the state of the union is improving coming out of the Omicron wave of the COVID-19 pandemic, much work remains. Including reminding this administration that it is empowered to protect patients, access to and affordability of care, an obligation to invest in public health programs beyond COVID and has committed to advancing efforts to End the HIV Epidemic.

A Patient’s Guide to 340B: Why Program Reform Matters to You

***This is the final report in a six-part series to educate patients about the 340B Drug Pricing Program***

The 340B Drug Pricing Program has no doubt added benefit for patients and providers, alike. The measure of this benefit, however, is shrouded by uncertainty over the lack of transparency and accountability, decline in hospital charity care, as well as the explosive middleman growth in contract pharmacies and pharmacy benefit managers. Twenty-nine years after the program’s inception, it is now unclear to both regulators and patients, both qualitatively and quantitatively, if the Congressional intent is being met.

With all the noise around whether rebate programs might encourage pharmaceutical manufacturers to raise the cost of their products, there is no conversation on how those rebate dollars are used. The lack of the requisite transparency reporting among non-federal grantee covered entities participating in the 340B program makes it impossible to distinguish between anecdotal claims of abuses versus legitimate use of these rebate dollars to the benefit of patients.

These combined situations place the future of the 340B program at exceptional risk, if only by politicization of the national conversation on medication affordability alone. That national conversation churns now, as Congress debates drug pricing legislation. Aside from notorious stump speeches about the prices other countries pay for their medications, nowhere in these discussions do we talk about payers (insurers) and the middleman dictating the at-the-counter prices of medications realized by patients. The ongoing political debate is absent of the larger impacts on safety-net programs benefitting from 340B revenue and the impact on the poorest patients among us. Without clear guidance, all patients can come to expect is more squabbling among covered entities, drug manufacturers, hospitals, and regulators. It is this type of environment in which an idealistic program finds itself at risk.

Lawmakers have reasonably argued federal regulators have not demonstrated a particular need for additional regulatory powers because the Health Services and Resources Administration (HRSA) has not adequately flexed their current oversight muscle (…much less that such would be exercised efficiently). Therefore, regulatory interpretation should be updated, specifically regarding the patient definition, and possibly with further defining “low-income” for more clarity on who the program should benefit most. To the extent of “cracking open the legislation”, there is a singular area in which lawmakers from both sides and the Biden Administration agree: the issue of transparency in reporting. Earlier this year, the Biden Administration’s discretionary budget included an ask of Congress to specifically fund greater oversight and administration of 340B, explicitly including requirements on reporting of how non-grantee entities use these dollars. In this space, where few agreements can be made found, this is one area where legislators can and should move swiftly. The data generated by transparent reporting on use of these dollars is invaluable in evaluating the efficacy of 340B in benefitting patients or otherwise meeting the intent of the program.

To the extent HRSA may need more room for rulemaking, legislators desperately need extend rulemaking authority to include allowable uses for 340B dollars and clarity on the intent of the program. Federal grantees already have to report use of these dollars while other covered entities aren’t. With executives reaping in millions of dollars, reasonable people can grow concerned these dollars are being used to prop up the profiteering and personal enrichment administrators may be enjoying at the expense of employees providing care and patients themselves. Employees of federal grantees don’t generally get to enjoy much in the way of raises and their pay is not on par with the private sector. Hardware and software systems lag in terms of keeping up with modern technology. Sustaining non-revenue generating or underfunded patient benefit programs is absolutely something many entities enjoy as a use of their 340B dollars. There is no doubt these dollars can be used to patient benefit beyond directly sharing the savings with patients, though sharing the savings is the most direct means patients benefit from 340B. Putting guardrails on allowable uses of these dollars would serve well everyone touched by the program. Frankly, anyone fighting this transparency as a suggested method of shoring up 340B in meeting its intended purpose has something to hide and deserves closer scrutiny.

As an additional area of critical need to consider, for non-grantee covered entity hospitals, records of charity care and minimum realized values in served communities should be determinative for qualification to participate as a covered entity. The current calculation of disproportionate share hospitals as 340B participants or non-340B participants by the Government Accountability Office has shown a steadier and steeper decline of charity care among 340B hospitals than among non-340B hospitals. Additionally, hospitals carry the highest issuance of medical debt in the United States, disproportionately affecting low-income patients. Part of ensuring low-income patients get the most benefit from the discount drug program was and remains the ability to extend no- and low-cost care, writing off costs of providing that care, without punishing patients for having a need. If hospitals are to receive the benefit of this program, that same benefit should be extended to patients.

Lastly, in addressing the sheer size of the 340B discount drug program, the most significant areas of growth with questionable benefit to patients are among contract pharmacies. HRSA’s recognized this potential in commentary with its 2010 final rule only to realize those cautionary concerns and integrate guidance curbing the use and growth of contract pharmacies in the no-shelved 2015 “mega-guidance”. While the mega-guidance has been shelved, the abuse of the program by contract pharmacies has not abated. Among reducing the number of contract pharmacies a covered entity may make agreements with, and other geographic requirements, lawmakers and regulators should consider establishing market appropriate flat fees associated with services and a database of fees charged by pharmacy benefits managers, contract pharmacies, and third-party administrators, similar to the 340B ceiling price database established under the Office of Pharmacy Affairs Information System. A similarly situated claims hub would also allow for greater clarity in audits, assessment of potential duplicate discounts, and (if appropriately structured and compliant with patient privacy laws) detect potential diversion.

340B is a massive program which, arguably, has not yet been realized by much of the patient population. Not doing anything in this case doesn’t mean “keeping things status quo”, rather it means leaving the program open to attack, inefficiency, ineffectiveness, and abuse. We can and should do more to ensure patients are aware of the program, how the program is used by covered entities nearest to them, and how this critical support to federally funded health care programs might be impacted by additional health care policy reform efforts. If ensuring the health and well-being of the country is the priority of all players in this system, then its time patients know it.

For more information on the issues facing the 340B Program, you can access the Community Access National Network’s 340B Commission final report and reform recommendations here.

Sources:

Community Access National Network (February 2019). 340B DRUG DISCOUNT PROGRAM: The Issues Spurring Discussion, Stakeholder Stances and Possible Resolutions. 340B Commission Final Report. Retrieved online at https://docs.google.com/gview?url=http://www.tiicann.org/pdf-docs/2019_CANN_340B_Commission_Final-Report-v5_03-07-19.pdf&embedded=true

A Patient’s Guide to 340B: Why the Middlemen Matters to You

***This is the fifth report in a six-part series to educate patients about the 340B Drug Pricing Program***

When the 340B Drug Pricing Program was enacted in 1992, there were a few “gaps” between the law’s statutory language and the program’s practical application. Among them was the realization that some covered entities that couldn’t afford to operate their own pharmacy. The Health Resources and Services Administration (HRSA) issued guidance to address the gap. After all, what’s the use of a discount drug program if providers can’t realize those discounts simply because they don’t have a pharmacy?

In 1996, after the urging of some covered entities, HRSA issued guidance telling covered entities and manufacturers that covered entities could contract with a single, independent pharmacy to provide pharmacy services necessary to engage the discount program. The idea was simple: create an access pipeline to the program, so it could be accessed by small providers, but not abused. In 2001, HRSA began to allow a few pilot projects, for lack of a better term, wherein covered entities would have more than one contract pharmacy. In theory, it isn’t a bad idea. Different pharmacies have different distributors, and as such supply can sometimes be an issue (i.e., natural disasters).

Additionally, it allows industrious covered entities to open the door for competition on “value added” services from contract pharmacies – such as programmatic record keeping for the purposes of 340B and/or financial reporting for federal grantees. And since the pharmacy was the one handling the purchasing and distribution of the medications to patients, that’s one less labor task for smaller covered entities to fund. In 2010, HRSA would later expand these pilot project allowance for multiple contract pharmacies per covered entity.

Sounds great, right? More patients have access to discounted outpatient medications, right?

Right? Not exactly!

Under the 340B program, patients don’t always get their share of the savings from the rebates and discounts. Arguably, it would appear everyone is directly benefiting one way or another from the program and its lucrative revenue stream, except for patients.

Contract pharmacies all want their piece of this pie, too. For example, take the dispensing fees that a pharmacy charges to fill a prescription medication. Indeed, dispensing fees for 340B contact pharmacies are so wildly non-standard a Government Accountability Office (GAO) report from 2018 found dispensing fees ranging from $0 to almost $2000 per fill on 340B eligible drugs. Those fees come out of 340B revenue, which could be supporting a patient’s ability to pay copays or the cost of a drug and instead.

Can you imagine, if you will, you’re a person living with HIV or Hepatitis C, living at about 200% of the Federal Poverty Level (FPL; 200% in 2021 is approximately $25,760 per year for a single person), but thankfully receiving insurance coverage for your medical care. Yet, co-pays and deductibles drain your finances when you could be getting your medications at no cost if the pharmacy or covered entity was applying 340B dollars to your bill? How many Rx fills would that be?

If the payer wasn’t applying a co-pay accumulator or co-pay maximizer program, the dispensing fee of two fills could mean extending your ability to access care for an entire coverage year – not just for medications, but for all health care. If the intent behind the 340B program is to extend limited federal resources, ensuring those exorbitant dispensing fees weren’t so exorbitant would certainly be one way to do it. Ultimately, 340B is a pie – when there’s more taken out, hacked at along the payment pipeline of getting medications to patients, there’s fewer resources left for patients to benefit from.

What’s more concerning about the explosive growth in the number of contract pharmacies with their hands in the 340B cookie jar, is HRSA knew when the 2010 guidance was issued that diversion and duplicate discount increases, abuses of the program, would most certainly follow. In part, because the program would grow and at such a pace that HRSA couldn’t keep up. In fact, GAO included that warning in a 2011 report, stating “…increased use of the 340B Program by contract pharmacies and hospitals may result in a greater risk of drug diversion, further heightening concerns about HRSA’s reliance on participants’ self-policing to oversee the program.”

The best part? By the “best”, I mean the worst: contract pharmacies, like non-grantee hospital entities, don’t have to show any benefit to patients for any of the dollars. Clearly, it raises questions over the legislative intent of the program and whether it is being met?

Now, contract pharmacies, like hospitals, like to massage and carefully select data to pitch answers to these concerns (there are a great number of “concerns”) by saying “we served X many 340B eligible patients”. They get around having to say if those patients realized any of those savings and benefitted from the program, without defining what they mean by “eligible”, and without defining “patient”. Contract pharmacies and hospitals get away with not having to provide meaningful information because statutory language doesn’t define “low-income” or “eligible” and regulatory guidance has an outdated definition of “patient”. Regardless of the existing language in regulation, a bona fide relationship should exist in order to call a consumer a “patient”, otherwise this is all just pocketing dollars meant for extending medication access to needy people.

All this lack of transparency fees assessed against the program could easily be solved with merely requiring contract pharmacies to establish a “flat”, reasonable dispensing fee and to describe what those fees actually cover. If the contract pharmacy is providing an additional navigation benefit to patients or an in-house location for a federally qualified health center, reasonable people can see fees being slightly elevated to cover additional costs. However, those costs should be outlined like any other contractor would be expected to do in any other contract for service. Most hospitals already have their own in-house pharmacy, they shouldn’t be contracting that service out and thus giving room for inappropriate 340B related rebate claims. And if HRSA just does not have the capacity to meaningfully audit 340B claims and the use of these dollars, they could at the very least make more room for the other mechanism in the statute for audit: manufacturer-originated audits. That’s right. The statutory language of 340B anticipated HRSA wouldn’t be able to keep up if the program was successful or even particularly abused. So, legislators reasoned if manufacturers were taking a cut of their potential profits through discounts and rebates, manufacturers should be able to audit the claims seeking those discounts and rebates to make sure everything was in line. When a retailer offers a discount to veterans, they typically require proof of veteran status. Why would medication discounts be any different?

In the end, if contract pharmacies don’t have anything to hide, then they need to stop hiding so very much. There are enough hands in the 340B cookie jar that patients are being squeezed out and left with crumbs. When legislators ask “is the intent of the program being met?”, these are the questions on their minds. Patients should have them on their minds as well.

For more information on the issues facing the 340B Program, you can access the Community Access National Network’s 340B Commission final report and reform recommendations here.

Sources:

Community Access National Network (February 2019). 340B DRUG DISCOUNT PROGRAM: The Issues Spurring Discussion, Stakeholder Stances and Possible Resolutions. 340B Commission Final Report. Retrieved online at https://docs.google.com/gview?url=http://www.tiicann.org/pdf-docs/2019_CANN_340B_Commission_Final-Report-v5_03-07-19.pdf&embedded=true

Fein, J. Adam (2020, May 19). Copay Maximizers Are Displacing Accumulators—But CMS Ignores How Payers Leverage Patient Support. Drug Channels. Retrieved online at https://www.drugchannels.net/2020/05/copay-maximizers-are-displacing.html

U.S Government Accountability Office (September 2011). DRUG PRICING: Manufacturer Discounts in the 340B Program Offer Benefits, but Federal Oversight Needs Improvement. GAO-11-836. Retrieved online at https://www.gao.gov/assets/gao-11-836.pdf

U.S. Government Accountability Office (June 2018). DRUG DISCOUNT PROGRAM: Federal Oversight of Compliance at 340B Contract Pharmacies Needs Improvement. GAO-18-480. Retrieved online at https://www.gao.gov/assets/gao-18-480.pdf

Office of the Federal Register (1996, August 23). 61 FR 43549 - Notice Regarding Section 602 of the Veterans Health Care Act of 1992; Contract Pharmacy Services. GovInfo.gov. Retrieved online at https://www.govinfo.gov/app/details/FR-1996-08-23/96-21485

Office of the Federal Register (2010, April 5). 75 FR 10272 - Notice Regarding 340B Drug Pricing Program-Contract Pharmacy Services. GovInfo.gov. Retrieved online at https://www.govinfo.gov/app/details/FR-2010-03-05/2010-4755

A Patient’s Guide to 340B: Why the Decline in Charity Care Matters to You

***This is the fourth report in a six-part series to educate patients about the 340B Drug Pricing Program***

A cornerstone argument in favor of the 340B Drug Pricing Program centers on so-called charity care rates of the participating Disproportionate Share Hospitals (DSH). Those covered entities, specifically DSHs, should be able to leverage their 340B dollars to extend care and out-patient medications to offset losses from uncompensated care. In the ideal, offsetting the costs associated with charity care to provide more care to low-income patients is noble and moral and just, and one society should support. The problem occurs when charity care is wrapped up or conflated with all “uncompensated, unreimbursed care” because a significant portion of uncompensated care is written off as bad debt, and that debt all too often gets reported to patients’ credit reports. Whereas charity care is care provided at no cost or debt to the patient. Moving forward, we must not confuse, conflate, or combine generalized uncompensated care with charity care.

The argument from the American Hospital Association is narrowly focused to present the rosiest picture, touting the totality of charity care provided by 340B DSH covered entities ($64 billion in of 2017, the latest available data as of the AHA’s statement). It ignores 340B participating hospitals have seen a steady decline in both charity care and uncompensated care, according to the Government Accountability Office’s 2018 report. The AHA’s own data reveals the same thing, despite exponential growth of the 340B program, largely attributed to hospitals and contract pharmacies. Unlike Federally Qualified Health Centers (FQHCs, a type of federal grantee entity in the 340B program), which are required provide care “regardless of ability to pay”, hospital systems, in large part, have a much more extensive debt collection program; they are not necessarily beholden to rules regarding debt collection practices. FQHCs, as an example, may be required to seek debt payments from internal billing specialists, but don’t generally have contracts to sell the bad debt to collections companies or report to credit bureaus. Furthermore, they are prohibited from doing so in certain circumstances.

While the Affordable Care Act (ACA) prohibited certain types of hospital-originated debt from being reported to credit bureaus, it doesn’t stop the hospital from selling the debt and then the collection company reporting the debt. Indeed, hospitals are notorious for reporting medical debt and sending bills to collections. If 340B dollars are meant to offset some of these expenses, with program growing about 23% per year, why does the Census Bureau report that about 20% of Americans are under some form of medical debt? Why has that medical debt grown from $81 billion in 2016 to $140 billion in 2019?

The ACA required non-profit hospitals to offer charity care programs, and the vast majority of hospitals across the country are non-profit hospitals. Adding insult to injury, that tax designation and the requirement to offer charity care hasn’t stopped these “non-profit” hospitals from chasing after low-income patients and further impoverishing them. A recent Kaiser Health News “An Arm and a Leg” podcast dove into just one state’s effort to tackle an epidemic of “non-profit” hospitals suing patients as a result of medical debt. The effort found a massive coalition of 60 entities, including a nurses’ union, and startling data supporting the need for Maryland’s now-passed “Medical debt Protection Act.”

Data included notation of almost 150,000 lawsuits against patients over the last 10 years, making almost $60 million from patients who would otherwise automatically qualify for charity care, and hospitals negotiating with for state funds to support charity care taking in $119 million than they actually gave out in charity care. And that’s just in one state. Indeed, according to information behind this report, Johns Hopkins – a 340B hospital – alone raked in $36 million more from this state-funded charity care support than they spent. While Maryland already had certain patient protections from these predatory practices on the books, too few patients knew about those protections and the state awarded these dollars without ever investigating the existing status of bad debt to charity care ratios. All the paper in the world written into the law is meaningless if affected people and corporations are not made to be transparent and held accountable.

Access to care, and freedom to access care, are two different things. Access to care being an open door, and freedom to access care is the freedom to walk through that door without fearing a dire financial consequence. While some special interests may argue the program is critical to hospitals extending access to care, their rhetoric lacks practical application when patients don’t have the freedom to access that care without fear of acquiring life-altering debt. The fear of medical debt keeps people away from seeking care. In fact, one of the most immediate and meaningful ways to tackle the country’s medical debt crisis would be for 340B covered entities to share the savings with patients. A patient’s medical debt reported to their personal credit file can, and does, perpetuate cycles of poverty; it is harming patients’ wealth, health, and overall well-being. If 340B dollars are supposed to be aimed at ensuring access to care, then concerns over medical financial toxicity shouldn’t be discounted.